- Which entities are liable to deduct TDS?

- Commencement of this Act

- Applicability and rate of TDS

- Registration of the deductor under GST

- Transitional Provisions

- Deposit of TDS with the government:

- TDS Certificate

- TDS Return Under GST

- Consequences of not complying with TDS provisions

- Refund on excess/erroneous TDS deduction under GST

- Some case laws and AAR rulings

- Conclusion

TDS (Tax Deduction at Source) is a mechanism devised by the government to collect both data and taxes in a timely manner. This process enables the government to have a trail of transactions and to monitor and verify the compliance as well. It is a very effective tool to prevent tax evasion and expansion of the tax net, as it provides for the automatic disclosure of the transaction. Earlier TDS was applicable only on Income tax, but now it has been extended to the GST regime also. Under the TDS all the entities liable to deduct TDS are Government bodies, or its associates or PSUs. Therefore there is a very remote chance of non-compliance. TDS under GST is governed by section 51 of the CGST Act, 2017.

Which entities are liable to deduct TDS?

The Government ( Central or state ) may mandate, the following entities to deduct TDS from its suppliers of goods or services ;

(a) a department or establishment of the Central Government or State Government; or

(b) local authority; or

(c) Governmental agencies; or

(d) such persons or category of persons as may be notified by the Government on the recommendations of the Council.

For the above clause (d), the category of persons is notified by the government wide Notification No. 50/2018 – Central Tax New Delhi, dated 13th September 2018. They are as follows ;

(a) An authority or a board or any other body, –

(i) set up by an Act of Parliament or a State Legislature; or

(ii) established by any Government, ( with fifty-one percent or more participation by way of equity or control), to carry out any function;

(b) Society established by the Central Government or the State Government or a Local Authority under the Societies Registration Act, 1860 (21 of 1860);

(c) public sector undertakings.

( hereafter all these entities shall be referred to as “deductor”)

Commencement of this Act

As per the Notification No. 50/2018 – Central Tax New Delhi, dated 13th September 2018 the provisions of section 51, of the said Act, shall come into force from 1st day of October 2018

Applicability and rate of TDS

(a) Rate of TDS

(i) The rate of TDS shall be 2%, (1% CGST + 1% SGST, or 2% IGST) to be deducted from the payment made, or at the time of credit to the supplier in the books (hereafter in this section referred to as “the deductee”) for the supply of taxable goods or services or both.

(b) Applicability

(ii) TDS will be deductible when the total value of such supply, under a contract, exceeds two lakh and fifty thousand rupees:

(c) Proviso

TDS will not be deducted if the location of the supplier and the place of supply is in a State or Union territory which is different from the State or Union territory of registration of the recipient.

(d) Example

In example 4, the location of supplier and place of supply, both are Delhi, which is different from the registered place of recipient, Haryana. Therefore, TDS will not be deducted.

| S no | Location of the supplier | Place of supply | Registered place of the recipient | TDS applicability | TDS rate |

| 1 | Delhi | Delhi | Delhi | Yes | 1% CGST +1% SGST |

| 2 | Delhi | Maharashtra | Punjab | yes | 2% IGST |

| 3 | Delhi | Uttar Pradesh | Uttar Pradesh | Yes | 2% IGST |

| 4 | Delhi | Delhi | Haryana | No | Proviso To Section 51(1) |

(e) Explanations

(i) For the purpose of deduction of tax specified above, the value of supply shall be taken as the amount excluding the central tax, State tax, Union territory tax, integrated tax and cess indicated in the invoice. i.e. TDS will only be deducted on the taxable value of supply.

(ii) If the total value of taxable supply exceeds Rs.2.5 Lakh under a single contract. This value shall exclude taxes & cess leviable under GST. TDS will be deductible.

(iii) If there is no contract and the value of multiple annual taxable supplies exceeds 2.5 lakhs then TDS will not be deducted.

(iv) If there are multiple contracts under which the value of annual taxable supplies exceeds 2.50 lakhs then also TDS will not be deducted.

(v) If the contract is made for both taxable supply and exempted supply, a deduction will be made if the total value of taxable supply in the contract exceeds Rs.2.5 Lakh. This value shall exclude taxes & cess leviable under GST.

(vi) TDS will be deductible when the advance is paid to a supplier on or after 01.10.2018, for the supply of taxable goods or services or both.

(vii) If the supplier is an unregistered person then TDS will not be deducted irrespective of the value of supply.

(viii) If the supply of services attracts RCM, then also TDS will not be deducted.

(f) According to Para 4 of the Standard Operating Procedure (SOP) issued by the Law Committee of GST

The following items will not attract the provisions of this section i.e. TDS will not be deductible on the following;

a) Total value of a taxable supply does not exceed Rs. 2.5 Lakh under a contract.

b) If the contract value exceeds Rs. 2.5 Lakh for both taxable supply and exempted supply, but the value of taxable supply under the said contract does not exceed Rs. 2.5 Lakh.

c) Receipt of services that are exempted. For example, services exempted under notification No. 12/2017 – Central Tax (Rate) dated 28.06.2017

d) Receipt of goods that are exempted. For example, goods exempted under notification No. 2/2017 – Central Tax (Rate) dated 28.06.2017

e) Goods on which GST is not leviable. Non-GST goods. For example, petrol, diesel, petroleum crude, natural gas, aviation turbine fuel (ATF), and alcohol for human consumption.

f) Where a supplier had issued an invoice for any sale of goods in respect of which tax was required to be deducted at source under the erstwhile VAT Law before 01.07.2017, but where payment for such sale is made on or after 01.07.2017 (after the implementation of GST)

g) Where the location of the supplier and place of supply is in a State(s)/UT(s) which is different from the State / UT where the deductor (recipient) is registered.

h) All activities or transactions specified in Schedule III of the CGST/SGST Acts 2017, irrespective of the value. (Activities or Transactions which shall be treated neither as a supply of goods nor a supply of services).

i) Where the payment relates to a tax invoice that has been issued before 01.10.2018. (before the notification of the said section).

j) Where any amount was paid in advance prior to 01.10.2018 and the tax invoice has been issued on or after 01.10.18, to the extent of advance payment made before 01.10.2018.

k) Where the payment relates to the “Cess” component.

(g) Some transactions where deductors have not to deduct TDS

(i) Supply made by one PSU to another

In the case when the supply of goods or services or both is made by one PSU (Public Sector Undertaking) to another PSU, provisions of TDS do not apply – proviso notified by Notification No. 57/2018 – Central Tax New Delhi, dated 23rd October 2018 made effective from 1.10.2018

(ii) Specified Authorities under Ministry of Defence

Authorities under the Ministry of Defence (other than those specified in Annexure A of Notification) are exempt from TDS compliance under GST by Notification No. 57/2018-CT dated 23-10-2018.

(iii) Transactions between Local Authorities / Government Agency / Central / State Government Department / Notified person

TDS provisions do not apply when the supply of goods or services or both is between persons specified in clauses (a) to (d) of sec 51(1) of CGST Act by Notification No.73/2018 – Central Tax New Delhi, dated 31st December 2018

Registration of the deductor under GST

- According to the Section 24(vi) of the CGST Act, 2017, a deductor of TDS under GST has to get himself compulsorily registered without any threshold limit.

- An entity that is liable to deduct TDS under GST will be required to get registered and obtain a GSTIN [Goods & Services Tax Identification Number] as a TDS deductor even if it is separately registered as a supplier. Therefore that entity will have two GSTINs, one as a voluntary taxpayer and the other as a Tax deductor.

- The deductor has the privilege of obtaining registration under GST without having a requirement to obtain PAN. It can obtain registration using its Tax Deduction and Collection Account Number (TAN) issued under the Income Tax Act, 1961.

Transitional Provisions

TDS provisions were made operational from 01.10.2018. Applicability of provisions on transactions prior to this date will be as follows :

- Supply was made before 1-10-2018 but invoice is issued after 1-10-2018, TDS provisions under GST will apply.

- A tax invoice was issued by the supplier before 1-10-2018 but payment is made after 1-10-2018, TDS provisions under GST will not apply.

- If any advance was received before 1.10.2018 and the invoice was issued after 1.10.2018, then TDS will not be deducted from the amount of advance. It will be applicable to the balance amount.

Deposit of TDS with the government:

- The amount of TDS has to be deposited to the Government account by the deductor by the 10th day of the succeeding month in which the tax has been deducted.

- In case the tax deducted is not deposited within the prescribed time period, the deductor would be liable to pay interest.

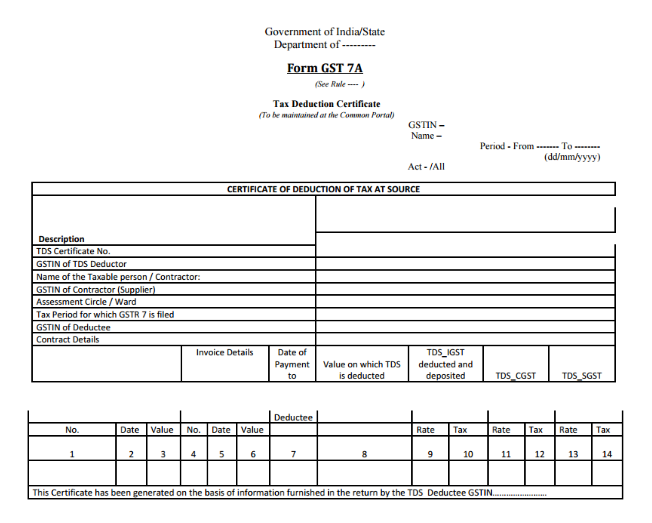

TDS Certificate

- A TDS certificate in Form GSTR-7A has to be issued by the deductor of TDS to the deductee (the supplier from whose payment TDS is deducted).

- Such a certificate should be issued within 5 days of crediting the amount to the Government account. Hence the last due date of issuing a TDS certificate is the 15th day of the succeeding month in which the TDS was deducted.

- For deducting TDS, the amount taken will be the taxable value of the supply, i.e. excluding all the types of GST and cess indicated in the invoice. For Eg. the amount of invoices submitted by the supplier is as follows;

Supply of service 50000

Add CGST (9%) 4500

Add SGST (9%) 4500

Total invoice value 59000

Less TDS deducted ( 1% of 50000) CGST ( 500 )

TDS deducted ( 1% of 50000) SGST ( 500 )

Amount paid to the supplier 58000

In the case of IGST, the amount of GST deducted would be the same but it would be deducted as 2% of IGST.

TDS Return Under GST

The deductor has to file a return electronically in Form GSTR-7 within 10 days from the end of the month in which the TDS has been deducted to avoid payment of any late fee, interest. [Section 39(3) of the CGST Act, 2017 read with Rule 66 of the CGST Rules, 2017]. The amount deducted by the deductor gets reflected in the GSTR-2A of the supplier (deductee). This amount will be credited to the electronic cash register of the supplier and he can use the same for the payment of tax or any other liability.

- The tax deducted by the deductor should be reflected in the return of the deductor and then it will be claimed by the deductee in his electronic cash ledger, – section 51(5) of the CGST Act.

- Thus, the deductee can take credit of this TDS in his electronic cash register only when the deductor has filed his return and not on the basis of the TDS certificate.

Consequences of not complying with TDS provisions

The following are the non-compliances and their penalties ;

| S No | Non Compliance | Effect of such Non compliance |

| 1 | TDS not deducted | Interest to be paid along with the TDS amount; else the amount shall be determined and recovered as per the law (sec 50 and 51) |

| 2 | TDS deducted but not paid to the government or paid later than 10th of the succeeding month | Interest to be paid along with the TDS amount; else the amount shall be determined and recovered as per the law. |

| 3 | TDS certificate not issued or delayed beyond the prescribed period of five days | A late fee of Rs. 100/- per day for the period of non-compliance subject to a maximum of Rs. 5000/- |

| 4 | Late filing of TDS returns | A late fee of Rs. 100/- for every day during which such failure continues subject to a maximum amount of five thousand rupees. |

Notes:

(i) For non-compliance of deduction of TDS– There is no specific section which deals with non-deduction of TDS under GST. But it can be conclusively assumed that the TDS amount which was not deducted along with interest ( not exceeding 1.5% per month) for the period (in months or part thereof) of such non-compliance (from the time it should have been deducted till it is deducted) has to be paid by the deductor. ( in line with the provisions of TDS under Income Tax act)

(ii) Sec 51(6)

(6) If any deductor fails to pay to the Government the amount deducted as tax under sub-section (1), he shall pay interest in accordance with the provisions of sub-section (1) of section 50, in addition to the amount of tax deducted.

(iii) Sec 50(1)

Interest on delayed payment of tax.

(1) Every person who is liable to pay tax in accordance with the provisions of this Act or the rules made thereunder, but fails to pay the tax or any part thereof to the Government within the period prescribed, shall for the period for which the tax or any part thereof remains unpaid, pay, on his own, interest at such rate, not exceeding eighteen per cent., as may be notified by the Government on the recommendations of the Council.

(iv) For not depositing TDS to the government account

Sec 50(1) shall apply. TDS amount not deposited along with interest ( not exceeding 1.5% per month ) for the period (in months or part thereof) of such non-compliance has to be paid by the deductor. ( in line with the provisions of TDS under Income Tax act)

(v) All these non-compliances are separate and penal interest shall be calculated for each non-compliance separately.

(vi) The determination of the amount in default shall be made in the manner specified in section 73 or section 74 of CGST/ SGST Act, 2017.

Refund on excess/erroneous TDS deduction under GST

- Any excess or erroneous amount is deducted and paid to the government account, then it shall be eligible for a refund under section sec 51(8) and sec 54 of the CGST Act, 2017.

- However, if the deducted amount is already credited to the electronic cash ledger of the supplier, the same shall not be refunded.

Some case laws and AAR rulings

(i) In 734 (AAR – KARNATAKA)[08-06-2021]

it was held that Tax deduction under section 51 shall be made by specified persons only if the total value of such supply, under a contract, exceeds two lakh and fifty thousand rupees.

The invoice amount is not the criteria but supply under a contract is the criteria for determining liability to deduct tax at source under section 51.

(ii) AAR: IIM, Tiruchirappalli a ‘Government Entity’ liable to deduct TDS

In this case, it was held that ‘The Indian Institute of Management, Tiruchirappalli (IIM)’ is a Government Entity Under GST Law.

Therefore the applicant is liable to deduct tax at source (TDS) under Section 51 of the CGST Act, 2017 read with Notification No.50/2018 dt. 13.09.2018.

(iii) AAR: Catering services to ITI students/trainees under Govt.: In re Hazrath Valiyaparambil Azeez (GST AAR Kerala)

It was held that the entity was providing an exempt service. Therefore it was not liable to deduct TDS u/s 51

(iv) AAR: ‘Ahmedabad Municipal Transport Service’

In this case, The Gujarat Authority of Advance Ruling (AAR) ruled that the ‘Ahmedabad Municipal Transport Service’ qualified as a ‘Local Authority’ and hence was liable to deduct TDS u/s 51.

Conclusion

As you can again see that the supplier is dependent upon the deductor to claim the TDS, deducted by him. The laws are skewed in favour of the deductor. Though the deductor has to face penalties for non-compliance, the deductee is not anyway benefited by that. The deductee should be allowed to claim such TDS, even if the deductor has not filed its return if he produces the TDS certificate. The supplier is already under a financial crunch because of the late payments from the Government agencies and then he has to wait for the deductor to file its return.

About the author:

CA Shaifaly Girdharwal is a qualified chartered accountant practicing in GST. She is the co-founder of ConsultEase.com and a famous YouTuber with more than 2,40,000 subscribers for her channel dedicated to the GST videos. Shaifaly is also a trainer and an author who has written a book on GST for Taxmann Ltd.