The Supreme Court today directed banks and financial institutions to restructure loans given to Amrapali home buyers and release the rest of the amount that was withheld so far.

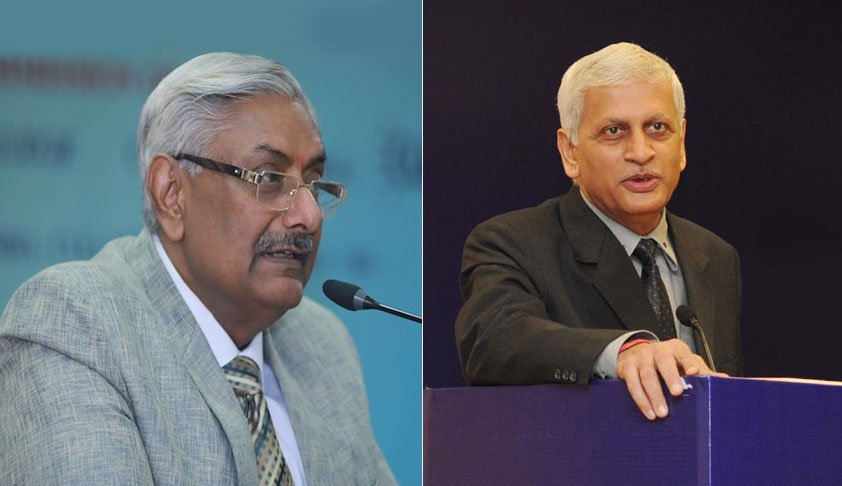

In a bid to ensure generation of funds and completion of stalled projects, the Bench of Justices Arun Mishra and UU Lalit has directed the Reserve Bank of India (RBI) to keep its circulars and guidelines related to Non-Performing Assets (NPAs) “in abeyance” for loans to the Amrapali home buyers.

The two-judge Bench has also directed that banks and financial institutions work out a “long-term restructuring of all home buyers’ loans about Amrapali Projects as well as any charges on the Amrapali home buyers project held by banks and financial institutions”. The order states,

“We direct the banks and financial institutions to release loans to home buyers, whose loans have been sanctioned, notwithstanding the fact that their accounts are declared as NPAs. Let there be restructuring of the loan amount. It may be released under the current norms of the RBI for releasing loans and the rates fixed by the RBI thereof.”

In the order, Justice Mishra further stated that “home buyers are not able to obtain fruits of the investment and are deprived of legal title of the flats”. For this reason, the Noida and Greater Noida authorities were directed to work out a schedule of funds they would need in order to wrap up the Amrapali Home buyers projects.

Also Read: IRDAI To Withdraw Long Term insurance Packages Of 2 And 4 wheelers

The Court also ordered that the balance Floor Area Ration (FAR) of various Amrapali projects be also sold through court receivers, so as to generate more funds that can be used to complete projects. Over 5,000 houses await completion in the Noida and Greater Noida regions, which covers more than 44,000 residential units.

SBI Capital had agreed to fund the stalled Amrapali projects with the collaboration of NBCC . Senior Advocate Harish Salve, appearing for SBI Cap, had submitted that they would be funding the stalled (net surplus projects) of Amrapali only.

The matter will be heard again next week.